Things about $255 Payday Loans Online Same Day

The 5-Minute Rule for $255 Payday Loans Online Same Day

Table of ContentsAn Unbiased View of $255 Payday Loans Online Same DayHow $255 Payday Loans Online Same Day can Save You Time, Stress, and Money.The Ultimate Guide To $255 Payday Loans Online Same DayThe Of $255 Payday Loans Online Same DayThe Basic Principles Of $255 Payday Loans Online Same Day

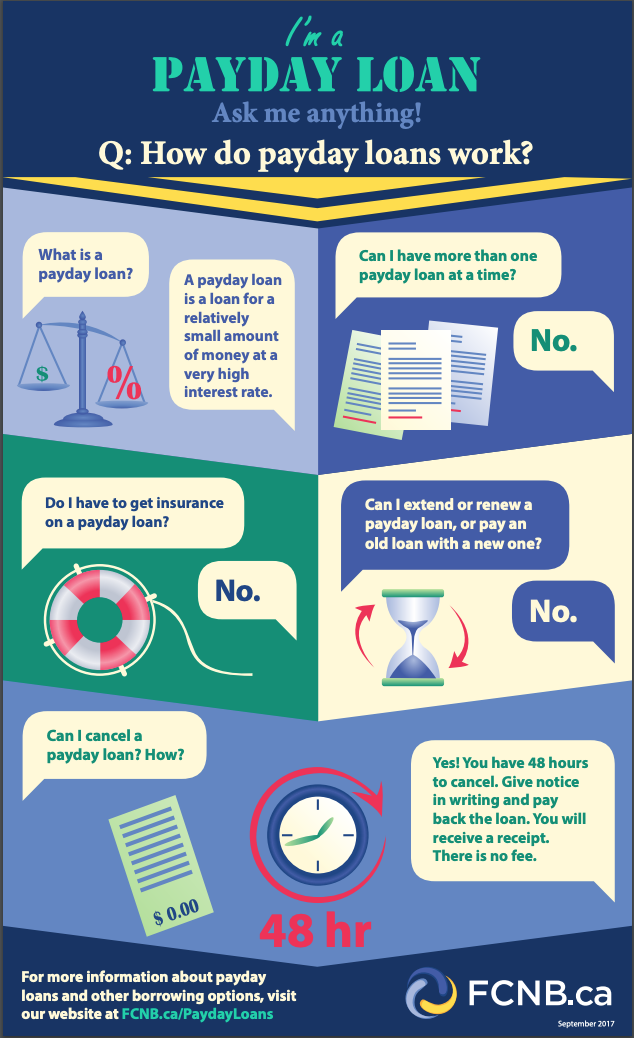

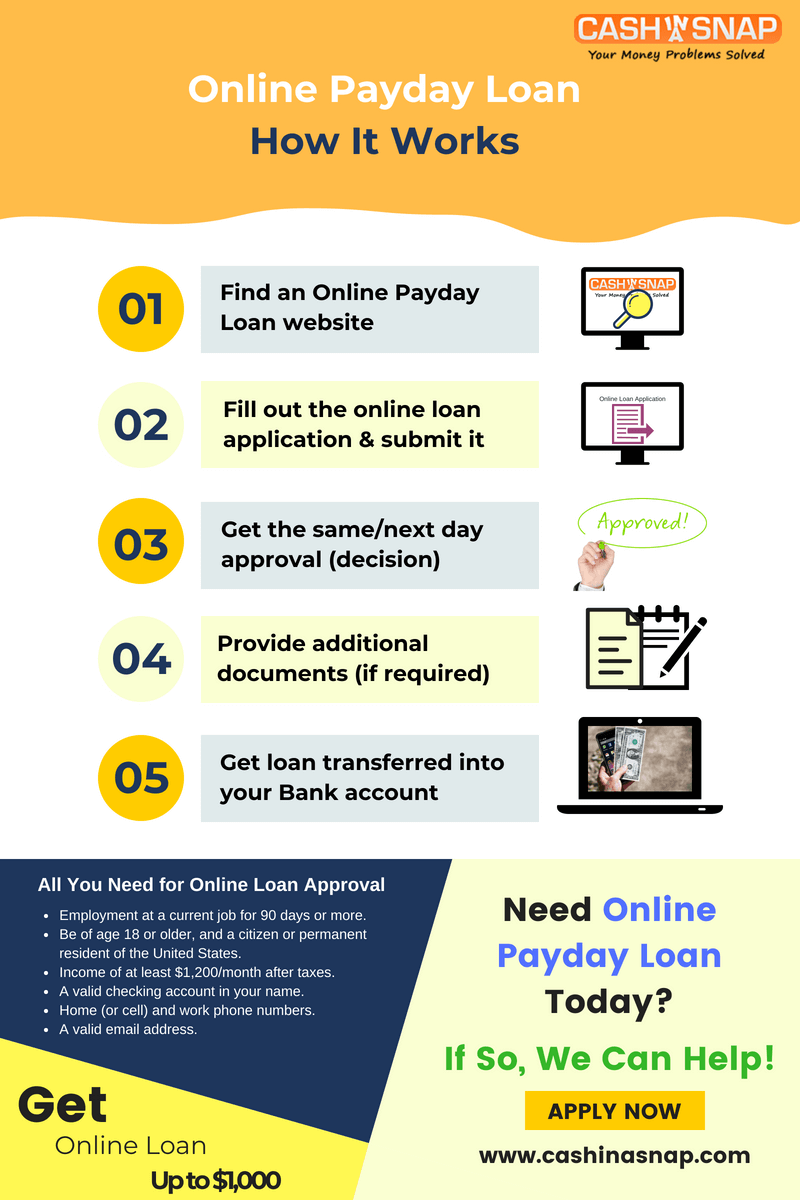

Cash advance car loans are short-term cash car loans based upon the debtor's personal check held for future deposit or on electronic accessibility to the borrower's checking account. Customers create a personal look for the amount borrowed plus the finance cost as well as get cash money. In many cases, debtors transfer digital accessibility to their checking account to receive as well as pay off cash advance loans.To pay a funding, debtors can redeem the check by paying the lending with cash money, permit the check to be deposited at the bank, or just pay the finance charge to roll the funding over for one more pay duration. Some cash advance lending institutions additionally offer longer-term payday instalment loans as well as request permission to digitally take out multiple settlements from the consumer's bank account, typically due on each pay day.

The average finance term is about two weeks. Finances commonly set you back 400% annual passion (APR) or a lot more.

All a customer needs to get a payday advance loan is an open checking account in reasonably excellent standing, a stable income, as well as recognition. Lenders do not conduct a complete debt check or ask inquiries to identify if a customer can manage to pay back the funding. Because fundings are made based upon the loan provider's capacity to accumulate, not the consumer's capability to pay off while fulfilling various other monetary commitments, payday loans produce a financial debt catch.

$255 Payday Loans Online Same Day Fundamentals Explained

Borrowers default on one in 5 payday car loans. Payday lendings are made by cash advance lending stores, or at shops that market other monetary services, such as check cashing, title fundings, rent-to-own and pawn, depending on state licensing requirements.

CFPB located 15,766 cash advance lending stores running in 2015. Fifteen states and the Area of Columbia shield their consumers from high-cost cash advance borrowing with affordable small lending price caps or various other restrictions.

Payday financings are not allowed for active-duty service participants as well as their dependents. Division of Defense policies apply to car loans subject to the government Reality in Loaning Act, including payday and also title finances.

The Customer Financial Security Bureau applies the MLA regulations. To submit a complaint, click right here. See: CFA press launch on revised MLA guidelines.

Getting My $255 Payday Loans Online Same Day To Work

We have actually all seen them. Intense yellow and red indicators with promises of instantaneous cash money to help you obtain to cash advance. As well as all you have to do is transfer your dignity and any type of remaining hopes of being economically stable in the future. Yupwe're discussing payday lenders. They're the bottom-feeders of the economic market.

But what you really obtain is a small cash advance as well as a heap of warm, steaming, lousy debt. So what do you do when you're down on your good luck, living paycheck to paycheck, have inadequate credit score, which squeaky wheel on your auto not only falls off however impacts up and you don't have the cash to cover it? Where do you turn? Payday financings are financings that help you receive from one cash advance to the following (for those times your income can't stretch to the end of the month) - $255 Payday loans online same day.

And also to cover it all off, Robert's credit scores is shot, and all of his credit score cards are maxed out. Feeling hopeless, Robert drives to his regional cash advance lender, skims the financing agreement (ideal past the astronomical rates of interest), and also signs his name on the dotted line in exchange for $300.

In order for the lender to look previous his repayment history (or do not have thereof) and inadequate credit history, Robert needs to write a check dated for his following payday in the amount he borrowedplus rate of interest. However what he does not realize is that by subscribing to get cash money quick, he simply made a gentleman's arrangement with the financial obligation evil one.

Get This Report on $255 Payday Loans Online Same Day

As an example, Robert took out a $300 funding. At a 15% passion price for a two-week funding period, he acquired $45 in rate of interest. However he couldn't pay it back in two weeks, so he determined to expand the funding (for an additional charge of training course). Now his $300 car loan has actually transformed right into $360.

At the end of the cycle, Robert will have just obtained $300 yet paid $105 in interest and also fees to the lending institution. 50% yearly find more interest price. Listen up: Cash advance loan providers are the monetary market's mobsters.

You see, when you register for a payday advance, you give the lending institution access to your examining account so they can deduct what they're owed (plus a charge) on paydayor you need to compose them a post-dated check.1 That's exactly how they understand you're great for the cash. Payday loan providers don't in fact care whether you can pay your costs or otherwise.

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

As well as to top it all off, Robert's credit rating is fired, and all of his bank card are maxed out. Really feeling determined, Robert drives to his regional payday loan provider, skims the lending agreement (right past the astronomical rate of dig this interest), as well as indications his name on the populated line for $300 ($255 Payday loans online same day).

$255 Payday Loans Online Same Day for Dummies

In order for the loan provider to look past his payment history (or do not have thereof) as well as bad credit rating, Robert needs to write a check dated for his next cash advance in the amount he borrowedplus interest. Yet what he does not recognize is that by subscribing to obtain cash quickly, he simply made a gent's arrangement with the financial obligation evil one.

Robert took out a $300 finance. At a 15% rate of interest for a two-week financing duration, he acquired $45 in passion. He couldn't pay it back in two weeks, so he chose to extend the funding (for one more charge of program). Now his $300 finance has turned right into $360.

At the end of the cycle, Robert will certainly have only navigate to this site borrowed $300 however paid $105 in passion and costs to the lending institution. 50% annual passion price. Pay attention up: Cash advance lenders are the economic industry's mobsters.

You see, when you enroll in a payday lending, you give the loan provider accessibility to your examining account so they can deduct what they're owed (plus a cost) on paydayor you have to write them a post-dated check.1 That's exactly how they recognize you're excellent for the cash. Payday lending institutions do not in fact care whether you can pay your costs or not.